This chapter contains the following topics:

Calculating Earnings, Deductions, and Taxes

Commissions From andCommissions To

You use the Calculate Payroll selection to calculate the employees’ earnings, deductions, and withholding taxes, and to prepare for printing payroll checks in the Checks selection.

Payroll is calculated for the current pay period and for up to four weeks of advance vacation pay. The advance vacation checks are calculated on the basis of a normal working week’s pay at the regular hourly rate, even if the employee is usually salaried or is usually paid at a frequency other than weekly.

After payroll calculations are made, the Time Worked Register, Payroll Register, and Deductions Register are printed. These registers detail the time entries, what is paid to the employees, and what is withheld or deducted from the employee’s pay.

You can print and post checks for time transactions in the new year before reporting W-2 and, as necessary, 1099 forms for the year just ended. You can also enter time transactions and print checks and post them up to the end of the 1st quarter in the new year.

For example, supposing the year just ended is 2014 and the new year is 2015. In this case, Control information specifies that the current payroll year is 2014. Transactions dated in 2014 can be entered and posted. Transactions dated in the first quarter of 2015 can be entered and posted. Transactions dated before 2014 or after the first quarter of 2015, (i.e. after March 31st), cannot be entered and posted.

When Close a year is run using this example, the quarterly data for 2014 and the year-to-date data for 2014 are purged, and any data already posted for the first quarter of 2015 is made available for reporting. The current payroll year in the Control information is updated to 15 from 14.

In Employees, one of the items you enter for an employee is how often that employee is paid. This is referred to as the employee’s pay frequency. If you specify that an employee is paid weekly then that employee’s pay frequency is Weekly. When you specify bi-weekly, (once every two weeks), the pay frequency is bi-weekly, etc.

The valid pay frequencies are:

| • | Daily |

| • | Weekly |

| • | Bi-weekly |

| • | Semi-monthly |

| • | Monthly |

| • | Quarterly |

In addition to specifying the regular, overtime, and special rates of pay for an employee, you can also specify up to 9 deduction or earning codes. These codes can be entered in any combination, or as all deduction codes, or as all earning codes. These codes are referred to as permanent deduction/earning codes, since they are stored with the employee record and can be used over and over again. Up to 6 temporary deduction and earning codes can be entered for each time transaction, but are not saved for use in the next payroll run.

When you enter permanent codes into the employee record, you also specify how often such a code is invoked. For example, a Weekly paid employee can also earn a fixed additional amount that is paid every two weeks. This additional earning is described as a Bi-weekly earning. Similarly, the employee can have a monthly deduction to a savings plan. This deduction is described as a Monthly deduction. Therefore, permanent deduction and earnings codes are categorized by frequency of invocation. Their frequency of invocation can be different, employee to employee.

|

Note |

If you use the multi-city and multi-state capability, fixed earnings, fixed 401k amounts, and fixed before tax deductions will be prorated for state and city tax calculations. |

When you select Time worked, you enter the pay frequencies for the employees for whom you are entering transactions. This enables you to limit the employees you are paying to just those who are paid at the selected pay frequencies. For example, by specifying that you are entering transactions for employees paid Weekly, the software warns you if you select an employee who is not paid Weekly. Entering time transactions does not invoke permanent deductions or earnings.

After you have completed entry of all time transactions for a payroll run, you must calculate the paycheck for each time transaction. This is done by selecting and running this selection, Calculate payroll. Before this selection can begin calculating, it must be told which categories of permanent deductions or earnings to invoke for that calculation run. You use the next screen to enter your selections.

|

Note |

If you make changes to the employee's settings, tax tables and deductions/earnings settings after you calculate and before you print checks and you want these changes to be included with the current check run, you must run calculate again. |

If you are using direct deposit, there is a field that determines if direct deposit processing is being done for the check run following this calculate.

Select

Calculate payroll from the PR menu.

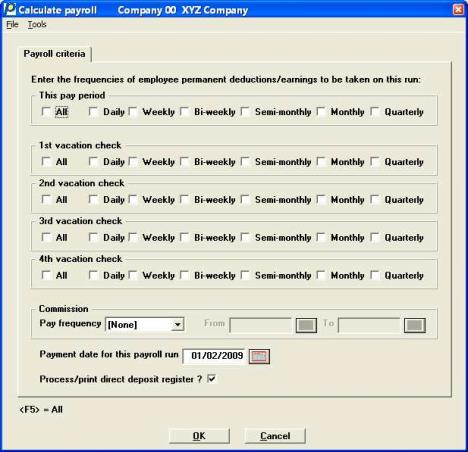

Graphical Mode

The following screen displays:

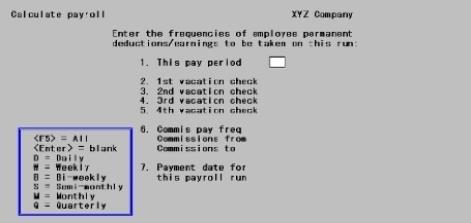

Character Mode

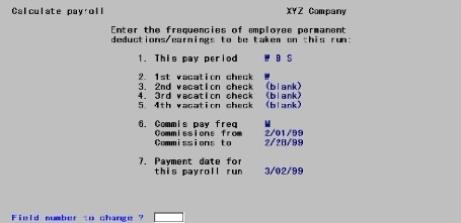

In character mode the following screen displays:

Enter the frequencies of the employee permanent deductions/earnings to be taken on this run:

Enter the frequencies of permanent deductions/earnings applied in this payroll calculation for each of 5 checks. These 5 checks are for the current pay period (called THIS PAY PERIOD on the screen), and up to 4 weeks of vacation paid in advance. (For further information, refer to the description and example given for deduction/earning frequencies in Employees.)

These are the frequencies of permanent deductions and earnings that are to be applied to the payments for the current pay period. You can enter up to 6 pay frequencies.

Options

| Character | Graphical |

| D |

Daily |

| W |

Weekly |

| B |

Bi-Weekly |

| S |

Semi-Monthly |

| M |

Monthly |

| Q |

Quarterly |

Enter the frequencies, or use one of the options at the first frequency field:

|

<F5> |

For All frequencies |

|

Down Arrow |

To skip this set of fields without specifying any frequencies. No permanent deduction/earning codes are taken on this run. |

|

Format |

Up to six frequencies with a check box for each, selected from the list above. |

|

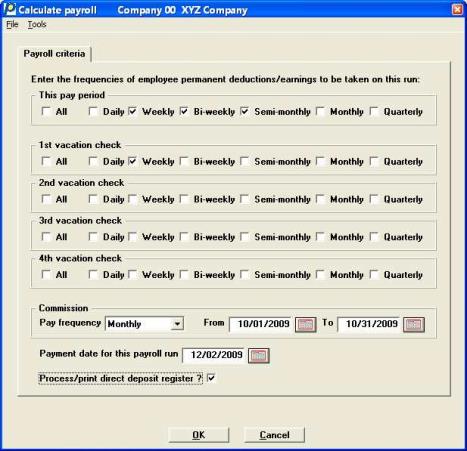

Example |

Select Weekly and then Bi-Weekly and finally Semi-Monthly, to include weekly, biweekly, and semi-monthly deductions and earnings on the payroll checks for the current pay period. |

Any Loan, Union or Garnishment deductions will be taken regardless of your setting for this field.

1st vacation check

2nd vacation check

3rd vacation check, and

4th vacation check

Options

Enter the frequencies of permanent deductions and earnings that are applied on the vacation check for the first week of vacation, the second week, etc. These are entered in the same way as the previous field.

|

<F5> |

For All frequencies |

|

Down Arrow |

To skip this field without specifying any frequencies. |

|

Format |

In each field, 6 frequencies of a check box each |

|

Example |

Select Weekly deductions/earnings on the payroll checks for the first vacation week. Press <Enter> at each of the remaining fields to indicate that employees will not get deductions from their paychecks on the second and subsequent weeks of their vacations. |

This is the frequency for commission payments. Enter the frequencies, as displayed in the pop-up selection window: Daily, Weekly, Bi-weekly, Semi-monthly, Monthly, and Quarterly, or press <Enter> to skip the field.

If <Enter> is pressed (skips field), and separate check commissions are set up through the Time work selection, this process, Calculate payroll will terminate and return to the Calculate Payroll parameters screen.

|

Format |

Check box |

|

Example |

Select Monthly |

From

To

The commission date range is used to smooth tax withholding for an employee. For example, a weekly employee who receives a regular salary of $100 and receives commissions of $400 on the last check of the month, would have withholding based on a weekly salary of $500. A truer estimate of the weekly salary would be $200. Using $200 instead of $500 for tax estimation is “smoothing” since it removes sharp weekly swings for withholding amounts.

Enter the starting pay period date and ending pay period date for commissions, respectively.

|

Format |

MMDDYY at each field. A default date displays in each field (the calculated beginning and ending date of the current week, month, or whatever other frequency you have chosen) |

|

Example |

Enter 110109 for the beginning date Enter 113009 for the ending date |

|

Note |

Employees who have additional tax deductions set up in their employee record will have the additional tax deductions withheld on the separate commission check. If an employee has a fixed additional tax deduction that starts after the Commissions from date or is terminated before the Commissions to date, too little tax may be withheld. This would not be the case with percentage additional tax deductions. |

Payment date for this payroll run

This is the check date for all the payroll checks being calculated in this run.

The payment date must be specified here and not when printing checks for the reason described below.

PBS Payroll allows you to continue calculating, printing, and posting checks beyond the end of a year into the first quarter of the next year.

Many taxes have limits based upon how much an employee has earned in one year. For example, in 2011, social security taxes are levied on the first $106,800 of income. Income above that limit is not taxed for social security. The Payroll software tracks earnings for the next year separately from the current year, so that the correct amount of tax is withheld from an employee’s paycheck. This also applies to certain employer taxes such as FUI and SUI.

Therefore, when calculating a payroll check, the software needs to know whether the check is paid in the current payroll year or the next one, so that the right pay records are used for tax calculations, such as described above.

Enter the check date to be used for this payroll run.

Options

You have the following option:

|

<F4> |

To select a date from the calendar lookup |

|

Format |

MMDDYY |

|

Example |

Type 80515 |

Process direct dep. for this run ?

or

Process/print direct deposit register ?

This field will not display if you if you selected to not use Payroll ACH Electronic direct deposit or Report only direct deposit in the Payroll Control information. In order for this field to have an effect, you must have at least one employee setup to accept direct deposit and the employee bank account is not in a pre-notification status.

If you check this box, the direct deposit amounts will be processed during the check run.

For ACH Electronic direct deposit this means the direct deposit amounts are processed, mailers are printed, the ACH file is created and the direct deposit register is printed.

For Report only, direct deposit amounts are processed, void checks are printed and the direct deposit register form is printed.

For either case, if not checked, the full pay amount will print on the checks, regardless of the direct deposit setup.

|

Format |

Check box, checked indicates yes and unchecked is no |

|

Example |

Select check box |

The screen should now appear as follows:

In character mode the following screen displays:

In graphical mode you may select Cancel to return to the menu and not process payroll. In character mode select the <Esc> key.

When you select OK in graphical mode or press <Enter> there will be a period of processing as the payroll is automatically calculated.

At the end of processing, three reports are printed. These are the Time Worked Register, Payroll Register, and Deductions Register. The Deductions Register shows voluntary deductions and does not print if no voluntary deductions were calculated during processing.

If you make changes to employee information, temporary or permanent deductions/earnings, or payroll time entries, you must run the Calculate payroll selection again before you print the payroll checks.

|

Note |

Payroll has a multi-city, multi-state feature that calculates the taxes prorated on fixed earnings, fixed before tax deductions, and fixed 401(k) deductions. If an employee’s wages are for more than one city or state, fixed earnings, before tax deductions, and fixed 401(k) deductions are prorated by the amount of wages for tax purposes. |

Warnings may print on the Time Worked Register or Payroll Register. Here is an explanation of a few of them:

Time Worked Register Warnings

You will be warned if an employee has exceeded the maximum vacation and sick hours. Here are the examples:

| • | Warning - Employee has exceeded maximum vacation hours Actual hours will be: .000 |

| • | Warning - Employee has exceeded maximum sick hours. Actual sick hours will be: .000 |

You are not required to do anything in either case. Notifying or compensating the employee is based on your company's policies. The check run will proceed without any problems. The sick or vacation accrued hours will not change for the employee during the run. If you are printing an accrued vacation and sick amounts on the check stub, these amounts will remain the same as the last check run.

Payroll Register Warnings

If the check amount exceeds the allowable maximums the Payroll Register will print warnings. Here are two examples:

| • | The above check had one or more calculations which exceeded the allowable maximum. |

| • | The employee Medicare withholding on the above check exceeded the allowable maximum of $9,999.99. |

If you encounter these errors on the Payroll Register do not print the check. Fix the data by splitting the amount into multiple check runs. Run calculate again before you print checks.

You may also encounter this warning in the Payroll Register:

| • | If you enter overtime hours in time worked and the employee has a zero or no rate for overtime hours, a Non-exempt salaried employee missing overtime rate !!! warning may print. For more specific information on what this indicates, see the Salary field in the Payroll chapter. |